At this time, there are many kinds of chart you can find on the

internet, one of them that is common, useful and easy to use is heiken

ashi chart, it's modified candle stick base on averaging technique. Here

is some information about it :

Heiken, it means “Average”.

Ashi , it means “Bar”.

And, this is the formula:

haClose = (Open + High + Low+ Close) / 4

haOpen = (haOpen(previous bar) + haClose(previous bar))/2

haHigh = Maximum(High, haOpen)

haLow = Minimum(Low,haOpen)

it's

base on the averaging technique, so, the signal will be later than the

signal of candle sticks, but it is smoother than candlestick's signal

and easy for you to indentified the trend and entry point.

There are five primary signals that identify trends and buying opportunities:

• Hollow candles with no lower "shadows" indicate a strong uptrend: let your profits ride!

• Hollow candles signify an uptrend: you might want to add to your long position, and exit short positions.

•

One candle with a small body surrounded by upper and lower shadows

indicates a trend change: risk-loving traders might buy or sell here,

while others will wait for confirmation before going short or long.

• Filled candles indicate a downtrend: you might want to add to your short position, and exit long positions.

• Filled candles with no higher shadows identify a strong downtrend: stay short until there's a change in trend.

These

signals show that locating trends or opportunities becomes a lot easier

with this system. The trends are not interrupted by false signals as

often, and are thus more easily spotted. Furthermore, opportunities to

buy during times of consolidation are also apparent.

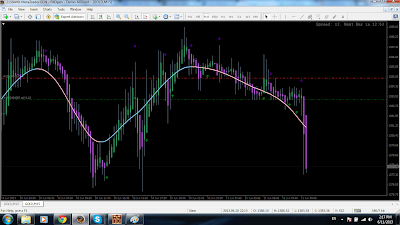

In MT4 platform we can't seperate hollow and filled candle, just can see like this, you can combine it with many trading system:

easy forex trader

Saturday, August 10, 2013

Simple way to Iidentify support and resistance

What is support and resistance? that's the level that price don't want to get over.

At first, we must identify the sideway zone of the price ( where prices repeat in there ), you can see this zone by using the bollinger band, when the high or low band stop extending, and the frequency of the price is consecutively growing, I use Market_Statistics_v6_0_Drag.mq4 indicator to show it. Mark the high and low of this range, we get the support and resistance level, where price hardly get over. for example you can see in this chart:

Drag the indicator to the trend where you want to analyze.

At first, we must identify the sideway zone of the price ( where prices repeat in there ), you can see this zone by using the bollinger band, when the high or low band stop extending, and the frequency of the price is consecutively growing, I use Market_Statistics_v6_0_Drag.mq4 indicator to show it. Mark the high and low of this range, we get the support and resistance level, where price hardly get over. for example you can see in this chart:

Drag the indicator to the trend where you want to analyze.

Simple forex trading stragety example.

Trend is friends! Similarly as other

basic strategies, this stragety is following the trend. before specify

the entry point, you must identify the trend, in my stragety, I use the at_ZDn.mq4 (a little repaint) indicator to identify it ( you can use HMA 80 to instead). after that, waiting for the entry point using IINWMARROWS alert.mq4

indicator, remember always set your stopsloss at the closest swing

point ( + spread), don't set your cutloss so far, that will make you

lose bigger, agree when it's wrong. For example:

at_ZDn.mq4 setting at default

IINWMARROWS alert.mq4 setting at : faster MA: 5 slower MA 8, faster MA and slower MA mode: 3

Nothing can satisfy your greed, take profit when you feel that enough or at the support, resistance level, of course how much you pay, how much you must get back, so tp at 1:1 or bigger, move your sl when you want to get more depend on swing point or IINWMARROWS indicator. If the market move so fast, don't try to get in, waiting for the retracement.

Hope it can help some one! good luck.

at_ZDn.mq4 setting at default

IINWMARROWS alert.mq4 setting at : faster MA: 5 slower MA 8, faster MA and slower MA mode: 3

Nothing can satisfy your greed, take profit when you feel that enough or at the support, resistance level, of course how much you pay, how much you must get back, so tp at 1:1 or bigger, move your sl when you want to get more depend on swing point or IINWMARROWS indicator. If the market move so fast, don't try to get in, waiting for the retracement.

Hope it can help some one! good luck.

Some economic indicators for fundamental analyzing

When business understanding and grasp the meaning

of information is extremely important. Information given should take

into account the time factor, accurately and bring the right decision

for investors. So you know the schedule announcement and understood the

concept of basic economic indicators yet?

Non Farm Payrolls:

The

unemployment rate is a measure of the labor market. An analysis of the

measure of the strength of the economy is the number one job is created.

This index indicates strong growth of the economy because the company

must create capacity to meet demand.

Schedule announced: the first Friday of the month at 8:30 am EST.

The decisions of the FOMC rate:

FOMC-Federal

open market committee: A committee set interest rate policy and credit

of the Federal Reserve System, the most important of monetary policy,

led by Chairman Alan Greenspan. FOMC meeting eight times a year, in the

meetings of the FOMC members will review monetary policy should change

how?

Federal Open Market established the

discount rate that the Federal Reserve to member banks for deposit in

the amount of debt overnight. Interest rates are set in during the FOMC

meeting of the regional banks and the Federal Reserve Board

Calendar published: 8 meetings per year. Last known date so please check on the economic calendar.

Trade balance:

The

trade balance measures the difference between the value of goods and

services that one country exports and the value of goods and services it

imports. The trade balance surplus if the value of exports over

imports, conversely, if the trade balance deficit if imports exceed

exports.

Schedule announced: generally

published around the middle of the 2nd month following the reporting

period. You should check the economic calendar each month.

CPI - Consumer Price Index

CPI

is a measure of inflation because it measures the price of a fixed

price of consumer goods. Higher prices are considered negative for one

economy, but because central banks typically respond to inflation by

increasing interest rates to monetary sometimes react positively in the

first reports of abuse found higher.

Measure the average change in prices of goods covered by the amount of the average consumer basket of goods and services fixed.

In

the U.S., the proportion of items in the basket of goods is 42%

residential, 18% food, 17% transportation, healthcare 6%, 6% jewelry,

entertainment 4%, other 7%.

CPI

is widely used to measure inflation, is an important indicator of the

impact of government policies. Increase in CPI inflation implies, is an

important indicator in the market and have the ability to change the

market, the larger increase in inflation expectations or trends appear

CPI increase will lead to incompatible Coupons and income and interest

will increase. Only the high inflation caused the change in the stock

market and will lead to changes in interest rates. High inflation effect

is difficult to determine the exchange rate, it leads to a decrease in

the exchange rate, the higher prices mean reduced competitiveness. High

inflation and interest rates lead to increased application of tighter

monetary policy.

Unlike

the other measures of inflation, only include goods produced in the

country, including CPI goods are imported. Analysts often focusing on

core CPI, this variation was accounted for 8 factors accounted for 16%

of the CPI basket (fruit, vegetables, gasoline, oil, natural gas,

mortgage interest, urban traffic and tobacco ). The calculation is done

for the CPI are calculated more accurately.

Schedule announced: monthly - about 13 days each month at 8:30 am EST

Retail sales:

The

retail sales index is a measure of the total amount of goods sold by

the example of the first retail stores. It is used as a measure of

consumer activity and confidence when selling higher numbers indicating

increased economic activity.

Schedule announced: monthly - about 11 days each month at 8:30 am EST.

Gross Domestic Product (GDP)

This

index measures the market value of goods and services produced in a

country, regardless of the nationality of the factors which owns the

resources. There are four main elements to the value of GDP are:

consumption, investment, government spending, net exports. The index is

published on a quarterly basis comparable reduction ratio% increase this

quarter compared with the previous quarter, this year compared to last

year. This index has an important influence on the market after being

released.

Subscribe to:

Comments (Atom)